DOUBLE ENTRY BOOKKEEPING AND INVOICING FOR YOUR SMALL BUSINESS, NON-PROFIT, OR CLUB.

Pay by the month (with auto-renewable subscriptions) instead of an outright purchase.

FEATURES HIGHLIGHT:

No limit on the number of company books.

No limit on the number of transactions.

Your data stored on your device. We have no access to your data.

Synchronise between devices using your own Dropbox account.

Built in example book so you can explore the program before making a commitment with an auto-renewable subscription.

Bookkeeping is a self contained mobile bookkeeping and invoicing solution for your iPad and iPhone. It has multi-device synchronisation using Dropbox so you can work on your books on any of your devices no matter where you are or what iTunes account you use; and it supports as many or as few currencies as you need.

You just need basic bookkeeping knowledge to make use of the multitude of capabilities of this program.

Bookkeeping works with or without cellular coverage.

Bookkeeping works wherever you are.

Synchronise when you get cellular/WiFi coverage again.

With Bookkeeping you have a fully functional program right on your iPad and iPhone.

Bookkeeping has been used in over 40 countries including the USA, Australia, United Kingdom, Canada, and South Africa. It is customisable to meet the bookkeeping needs that are specific to your country.

Some of the Bookkeeping features …

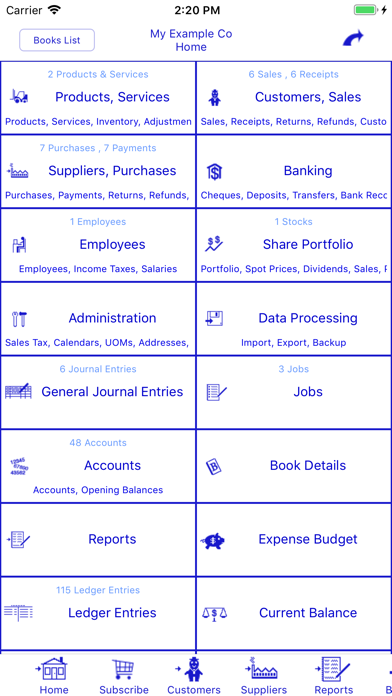

- Configure separate Company books for each company you operate

- No limit to the number of Transactions

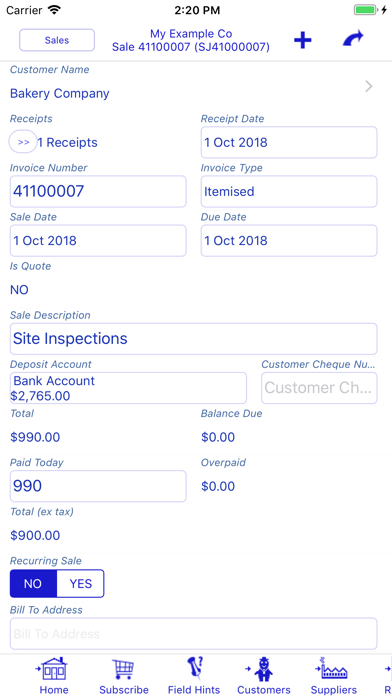

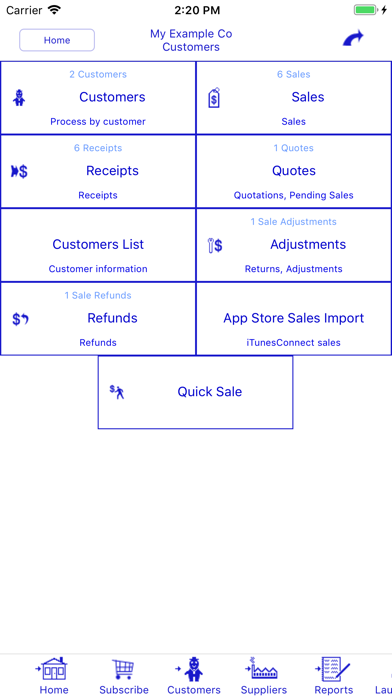

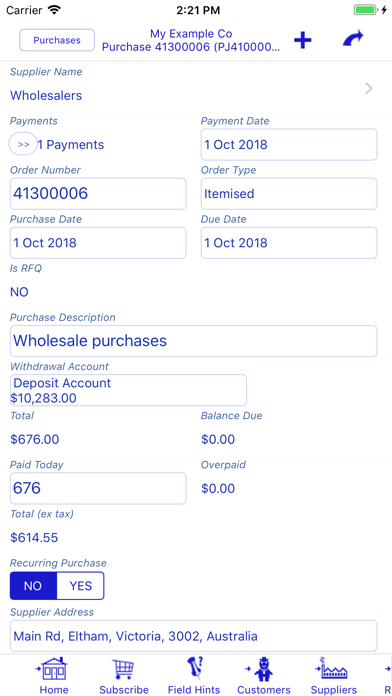

- Invoicing , Quotations , RFQs , Purchase Orders

- Email or Print all Invoices, Quotes, Orders, and Reports in convenient PDF format

- Adjustments, Returns, Refunds

- Supports non-standard financial periods

- Recurring transactions

- Cheque Book, Deposit Book, Bank Transfers

- Bank Reconciliation

- Import Bank Transactions

- General Journal

- Expense Budgeting

- Configurable sales tax codes (Sales Tax, VAT Tax, Goods and Service Taxes, etc)

- Multiple sales taxes per line item

- Complex sales taxes (e.g. Canadian PST+GST, Philippines)

- Calculate levies, duties, importation taxes

- Calculate credit card merchant fees deducted from payments

- Dropbox integration

- AirPrint and WePrint printing

- Products, Services, & Inventory

- Separate product prices per currency

- Automatic Cost of Goods Sold calculations

- Share Portfolio

- Multi-Currency Support

- Foreign currency transactions

- Foreign currency bank accounts

- Global Search

- Job Tracking

- Bank Reconciliation

- Departments & Trading Names

- Multi-Device Synchronisation

- Configuration options to tailor to your needs

- 47 PDF Reports (Trial Balance, Balance Sheet, Profit & Loss, etc)

- Taxable Payments Reporting for the Australian Building and Construction industry

- Australian BAS Worksheet reporting

- Built in tax codes for Australian GST

- Support for WET (Wine Equilisation Taxes)

- GST Compliant Adjustment Notes

Purchase an auto-renewable subscription to be able to enter data into this program. If you do not have a valid auto-renewable subscription, then you can load the example book and can view the information in the books. However you are required to purchase and maintain an auto-renewable subscription to enter data into the program. Payment will be charged to your iTunes Account at confirmation of purchase. The subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period. Your account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal. Subscriptions may be managed by you and auto-renewal may be turned off by going to your iTunes Account Settings after purchase.

The EULA, Terms of Service, and Privacy Policy can be found in the About screen of this application and on our website.

Privacy Policy: https://bookkeeping.warby.com/Privacy

Terms of Use: https://bookkeeping.warby.com/Terms

End User License Agreement: https://bookkeeping.warby.com/EULA